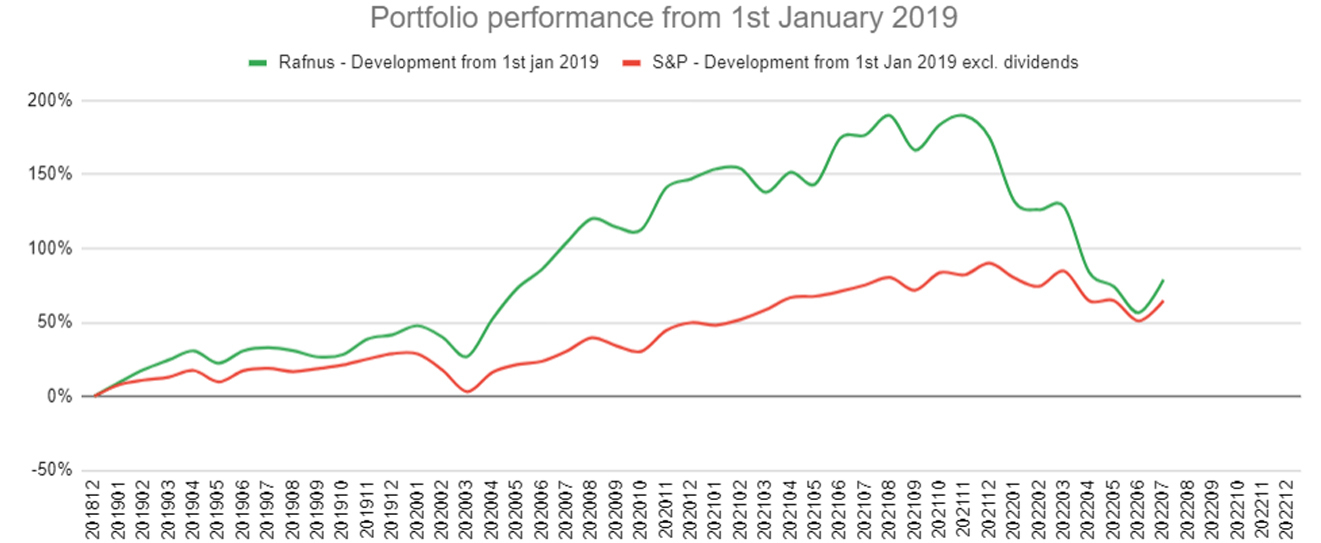

The portfolio is beating the market

The portfolio is doing much better than the market (S&P500) and increasingly beating the market the more time that passes, this is the impact of it consistently beating the market and compound interest. Based on my past performance, I predict the portfolio to return 20-40% annually on average in the long run (see my calculations and assumptions below).

Source: eToro & Finance.Yahoo.com

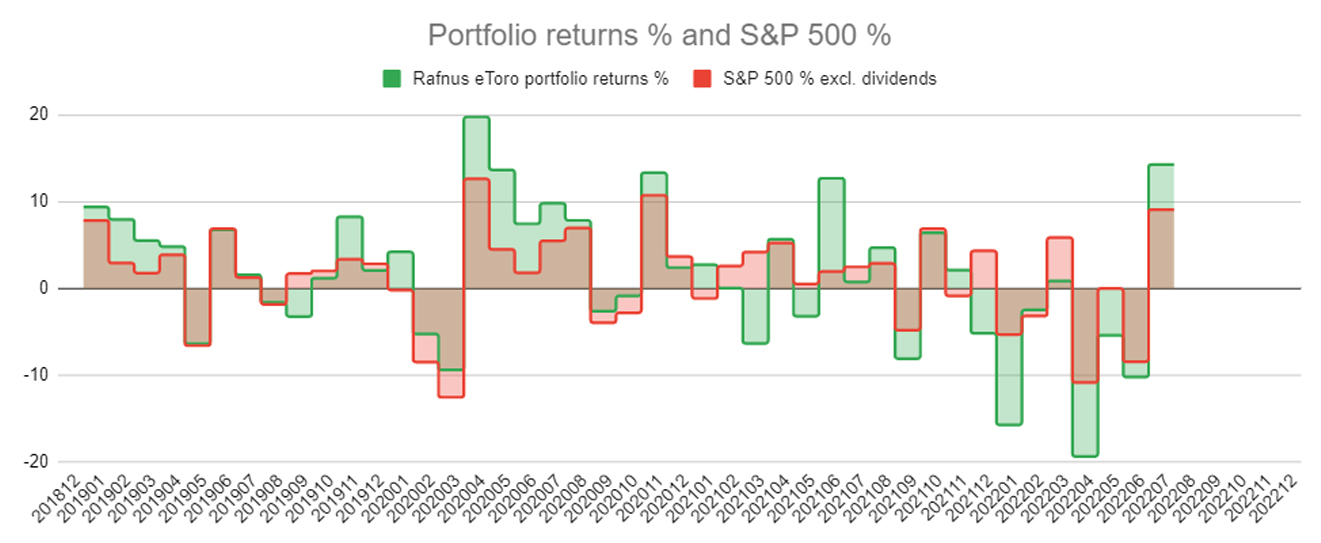

When comparing the portfolio against the S&P500 on a monthly basis, it shows the portfolio does better in a positive as well as a negative market in most months. This is really positive and shows the resilience of the portfolio over time.

Source: eToro & Finance.Yahoo.com

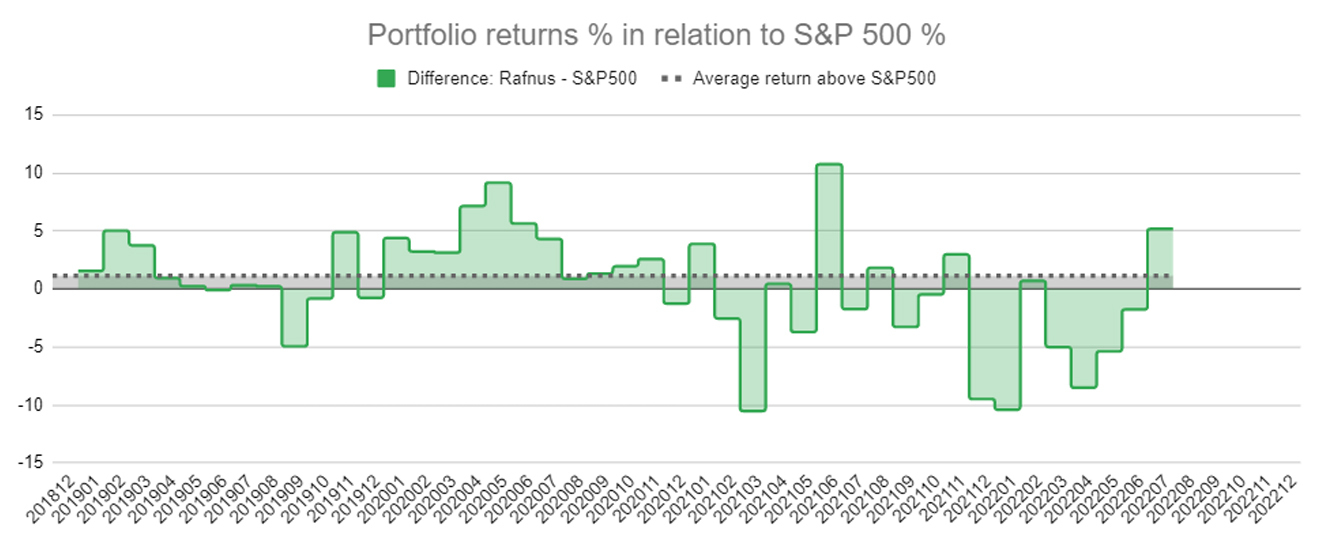

When looking specifically at the difference each month, between the portfolio and the S&P 500, the portfolio is doing better than the market in more than 50% of the months. On average the portfolio has done better than the market as shown with the greyed area below.

Source: eToro & Finance.Yahoo.com

With two full years of trading statistic, I have tried to predict my expectations for the future portfolio returns. Important to note that past returns is no guarantee for future returns.

A couple of assumptions used for the calculations below:

- The S&P500 return 7-9% annually over time

- The portfolio continues to deliver better than the S&P500 by an average of 2.2% as it has done on average through 2019 and 2020

| S&P 500 return | 0.65% per month | => | 8% p.a. |

| Portfolio overperformance | 2.20% per month | ||

| Total portfolio performance | 2.85% per month | => | 40.1% p.a. |

To be a bit ‘conservative in the predictions, because it after all is based only on two (good) years of statistics, a second calculation where the anticipated monthly overperformance is reduced to 1%.

| S&P 500 return | 0.65% per month | => | 8% p.a. |

| Portfolio overperformance | 1.00% per month | ||

| Total portfolio performance | 1.65% per month | => | 21.7% p.a. |

Based on these calcualtions, my best estimate for future returns is between 20-40% per year on average. Some years will be better and some will be worse, but I am confident the portfolio will continue to outperform the S&P500 in the long run.

Note that past returns are no guarantee for future returns.